Venture capital moves fast. The stock market and best deals don’t wait. Yet, every investment professional knows that investment validation often slows down the process. Traditional methods rely on lengthy due diligence, manual reviews, and endless data requests.

But things are changing. Investment validation tools built on modern developer technology are helping investors move from pitch to product faster than ever. These tools simplify analysis, reduce risk, and provide real-time insights. All these make asset managers’ lives easier.

In this article, we’ll explore how developer tools can reshape investment validation. We’ll cover the problems clients face with traditional methods, the rise of automation, real-world examples, and practical strategies for venture capitalists (VCs) who want to move faster without losing accuracy.

Highlights

- Investment validation tools automate due diligence, replacing slow manual reviews with real-time data, AI-driven analysis, and APIs that cut months of work into days or even minutes.

- Developer technology boosts speed, scalability, and accuracy. This allows VCs to evaluate multiple deals at once, reduce human bias, and improve decision-making efficiency.

- Adopting these tools creates a competitive edge. This helps VCs close more deals faster, attract limited partners with transparent methods, and prepare for future advances. These can include AI copilots, predictive models, and blockchain validation.

What is investment validation?

At its core, investment validation is the process of assessing whether an idea, product, or startup with AI MVP is truly worth funding. As much as it sounds straightforward, you need to focus on details.

It answers questions like:

- Does the product solve a real problem?

- Is the business model sustainable?

- Can the team deliver?

- Are the risks manageable?

Instead of betting blindly, investors use validation methods such as:

- Running code quality checks

- Reviewing product roadmaps

- Analyzing and tracking early customer data

- Checking financial and compliance health data

This shift makes investing less about promises, more about proof.

What are investment validation tools?

Investment validation tools are digital platforms, software, and frameworks that help investors verify the potential of a startup or idea before funding it.

Instead of relying solely on gut instinct or slide decks, these tools bring data, automation, and developer-level analysis to the table.

Think of them as a toolkit for answering key questions:

- Does the market exist?

- Can the product scale?

- Are the numbers reliable?

- Is this worth the investment?

These tools reduce uncertainty. They allow investors to validate financial models, test customer demand, check compliance risks, and even simulate product scalability.

The big advantage? Speed.

Validation that once took months can now be done in days—or even minutes.

Types of investment tools

Traditionally, investors classify tools into four categories:

- Financial tools. These analyze financial health and projections. Examples include Excel models, QuickBooks, and AI-powered forecasting software.

- Market tools. These gauge market demand and competitor landscape. Examples include Crunchbase, PitchBook, CB Insights.

- Operational tools. These check how efficiently a business can run. Examples include compliance automation tools like Numeral and workflow trackers such as Notion.

- Product tools. These validate the actual tech or product performance. Examples include Postman for API testing, GitHub for code transparency, and cloud deployment testing.

When combined, these four types of tools form the foundation of modern investment validation.

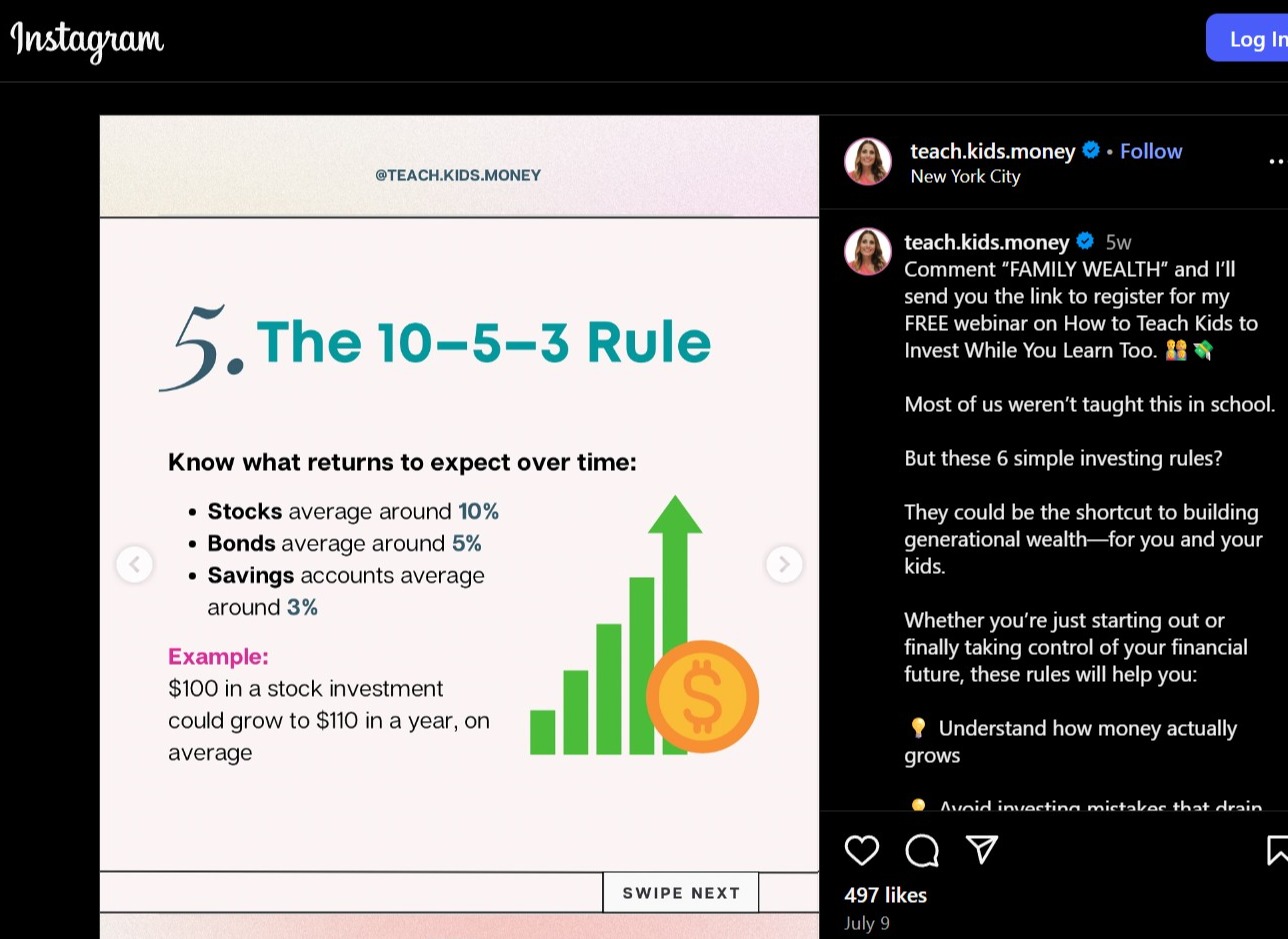

The 10-5-3 rule of investment

You’ve probably heard of it. The 10-5-3 rule of investment is a simple guideline:

- 10% average return from stocks over time

- 5% return from bonds

- 3% from cash or savings accounts

This rule isn’t perfect, but it helps investors benchmark expectations and mitigate risks.

Now, here’s where it gets interesting: with investment validation tools, VCs can stress-test these assumptions for startups.

For example:

- Is a startup’s projected 10x growth realistic compared to market norms?

- Are their cash flow forecasts more “dream” than reality?

- Does their risk profile align with this 10-5-3 balance?

By blending old-school wisdom with new developer tools, investors can assess inflated projections early.

Tools used in investment appraisal (Informed investment decisions)

Investment appraisal is the structured evaluation of an opportunity. The goal? To decide if the project is financially viable.

Here are the main tools used:

- Net present value (NPV). Calculates the present value of future cash flows.

- Internal rate of return (IRR). Measures the profitability of potential investments.

- Payback period. Shows how long it takes to recover the initial investment.

- Profitability index (PI). Evaluates investment attractiveness.

Traditionally, these were done manually with spreadsheets. Today, software like Fathom, Finmark, and Vena automate the entire process.

When combined with developer tools that test product scalability, investors get a 360-degree view of both the financial and technical viability.

Why traditional investment validation slows you down

Investment validation has always been a bottleneck. Deals can take weeks or months to evaluate. By the time due diligence is complete, opportunities may have already passed.

Why is it so slow?

- Manual processes. Teams dig through spreadsheets, reports, and legal docs.

- Unstructured data. Startups often present scattered information.

- Human bias. Decisions often lean heavily on gut feeling, rather than just facts.

- Every new deal requires repeating similar background checks.

The problem isn’t a lack of interest. It’s a lack of speed. Traditional methods don’t match the fast-moving startup ecosystem.

This is where access to investment validation tools powered by developer technology steps in.

Trading strategies: What do investment tools include

At their core, investment validation tools are software systems that automate the process of evaluating startups. They take raw data, analyze it, and provide actionable insights.

These tools can include:

- APIs for data collection. Pulling financial, legal, or operational data automatically.

- AI models. Identifying risks and projecting growth.

- Benchmarking dashboards. Comparing startups to industry standards.

- Scenario simulations. Testing how products or teams might perform under pressure.

In short, they are developer-built solutions that transform slow due diligence into a fast, data-driven process.

Think of them as your investment copilot. They don’t replace human judgment. They enhance it.

Why developer tools change the game for informed investing decisions

The difference between traditional spreadsheets and modern developer tools is night and day. Developer tools bring three key advantages:

- Automation. Tasks like compliance checks or market sizing can run automatically in minutes.

- Scalability. You can review 10 deals at once instead of one at a time.

- Accuracy. Algorithms reduce human error and bias.

MIT Sloan School of Management states that generative AI can improve employee performance by nearly 40%.

Developer tools aren’t just nice-to-haves. They are becoming essential for fast-moving venture funds. Consider highlighting how solutions like gaming lounge management software demonstrate the scalability and automation benefits that developer tools bring to different industries.

Real-world example: Life settlement market

A powerful case study comes from the life settlement market. They discovered that the policy valuations once took 1–3 months of paperwork. Now, with AI-driven validation tools, the process happens in under one minute.

These results come from using machine learning algorithms to analyze complex medical and financial data instantly. Digital platforms also strip away confusion, making options more accessible for investors and enhancing the overall investor pitch.

The impact? Institutional investors are flocking to the space because the process is now transparent, fast, and reliable.

This same principle applies to venture capital. Imagine moving from three months of diligence to three days. That’s the promise of investment validation tools.

Investment validation tools in action

Let’s break down how investors can actually use these tools step by step.

1. Data Collection

Instead of asking startups for endless files, APIs can automatically gather:

- Banking data

- Revenue reports

- Customer growth metrics

- Legal filings

This cuts weeks of back-and-forth.

2. Risk Analysis

AI models can:

- Spot irregularities in financial data

- Predict churn rates

- Detect potential compliance issues

This gives investors a clearer risk profile before human review.

3. Benchmarking

Dashboards compare startups against competitors:

- Growth vs. industry average

- Burn rate vs. sector norms

- Market adoption speed

Investors instantly see if a startup is an outlier or on track.

4. Scenario Simulation

Tools can model:

- Best- and worst-case revenue paths

- Hiring and scaling challenges

- Market downturn impact

These simulations help VCs understand resilience under pressure.

With each step automated, decisions become faster and sharper.

Benefits for VCs and partners for fixed income investments

For venture capitalists, time is everything. Faster validation means:

- Quicker deal flow. Close more deals before competitors.

- Lower costs. Reduce hours spent on manual research.

- Better accuracy. Data-driven insights reduce bias.

- Stronger trust. Limited partners see you using advanced, transparent methods.

According to Affinity, 92% of VCs who adopt AI to improve and optimize due diligence will see significantly better results.

Faster doesn’t just mean more deals. It means better ones.

Commonly used investment validation tools for investment research

Here are some popular categories of tools used today:

- Plaid & Finicity – APIs for financial data aggregation.

- Carta – Cap table and equity management.

- PitchBook & Crunchbase – Market and company data platforms.

- Snowflake & Databricks – Data warehousing and analytics.

- Custom ML models – Tailored algorithms for deal screening.

Each tool covers a different slice of validation. Together, they build a complete picture of a startup’s potential.

The key for VCs is integrating these into a single streamlined workflow.

Challenges and risks to consider when working over the counter

Of course, developer tools aren’t perfect. They bring challenges that investors must manage carefully.

- Data privacy. Sensitive financial and personal data must be handled securely.

- Algorithm bias. Models may overlook unique founders or unconventional businesses.

- Over-reliance. Tools support judgment, but humans must still make final decisions.

- Integration complexity. Combining multiple APIs and platforms requires tech expertise.

The goal isn’t to replace humans with machines. It’s to combine the speed of automation with the wisdom of experienced investors.

How to start using investment validation tools for fixed income

If you’re a VC or investment partner ready to adopt these tools, here’s a roadmap:

- Identify bottlenecks. Where does your diligence process slow down? Compliance? Market analysis?

- Select tools. Pick platforms that target those bottlenecks.

- Integrate data sources. Use APIs to connect banking, legal, and product metrics.

- Test workflows. Start with one deal cycle to measure time saved.

- Scale gradually. Roll out across your portfolio as confidence grows.

The goal is not to overhaul everything at once. The goal is to build a smarter, faster process step by step.

The future of investment validation

Looking ahead, investment validation tools will only get stronger. Expect to see:

- AI copilots. Conversational bots guiding due diligence in real time.

- Predictive models. Forecasting long-term survival rates with high accuracy.

- Blockchain integration. Immutable audit trails for deal transparency.

- Cross-border validation. Automated compliance for international investments.

By 2028, Accenture predicts that over 64% of deal closings will come from AI-driven analysis.

The VC firms that adopt these tools early will have a competitive edge.

Final Thoughts

Venture capital has always been about speed and insight. The faster you validate, the more deals you can capture. The smarter your tools, the more accurate your bets.

Investment validation tools are changing how deals are done. From pitch to product, they reduce the lag and guesswork and give investors a clearer, faster, and more reliable path to decision-making.

The message for venture capitalists and investment partners is simple: embrace these tools now, or risk falling behind.

The future of investment isn’t just about the startups you back. It’s about the tools you use to back them.